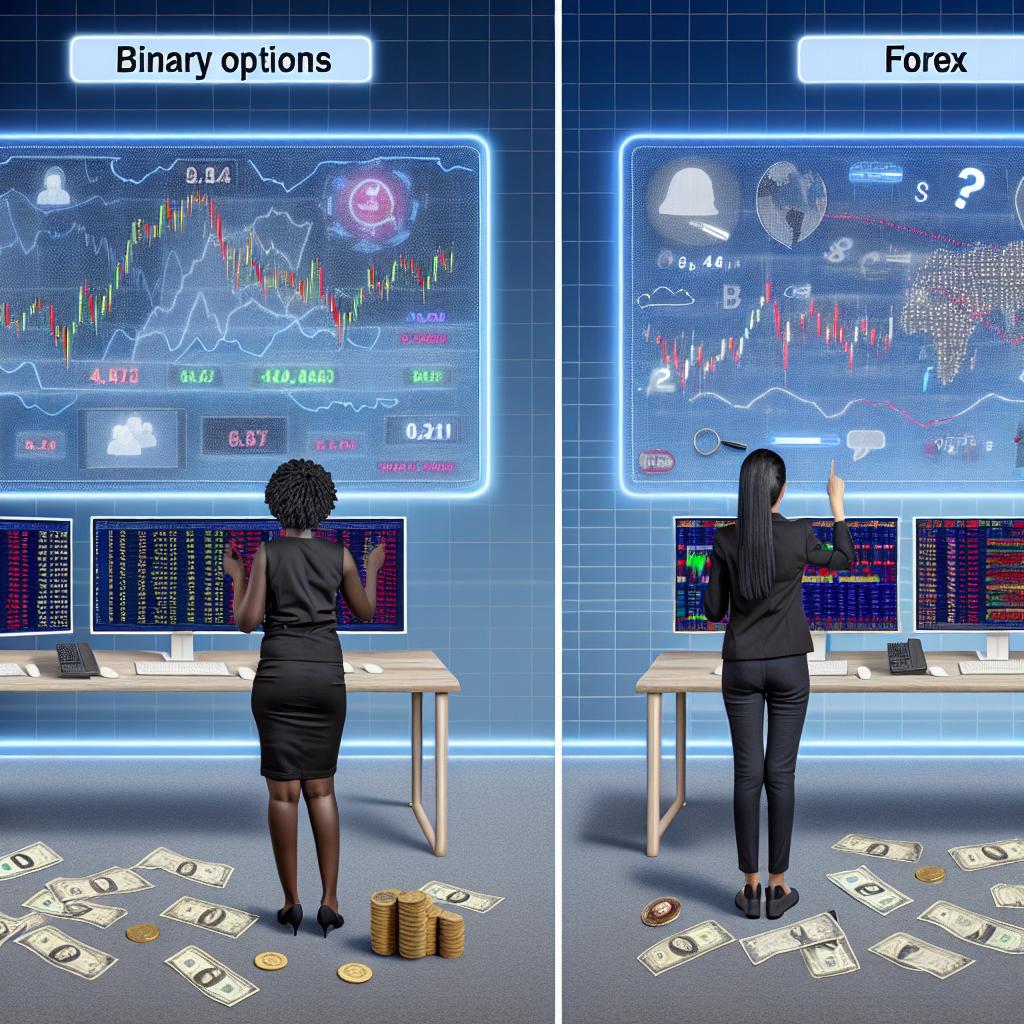

The Difference Between Binary Options and Forex Trading

When it comes to online trading, both binary options and Forex trading are popular options for investors. Despite being financial instruments, they have distinct characteristics that set them apart. Understanding these differences is essential for any trader considering these markets.

Definition and Nature of Trades

Binary options are financial instruments that allow investors to speculate on the price movement of various assets, such as stocks, commodities, currencies, and indices. The term “binary” refers to the two possible outcomes: receive a fixed payout or lose the investment. Traders predict whether the asset’s price will be above or below a certain point at a predetermined time. This specific mechanism allows for a simplified trading decision-making process since the potential outcomes are clear-cut. The emphasis in binary options is primarily on the direction and behavior of asset prices over a specified period and not on the extent of the price movement. This simplicity attracts many new traders who are looking for straightforward ways to invest in financial markets without extensive analysis.

Forex trading, on the other hand, involves the buying and selling of currency pairs. Traders exchange one currency for another at agreed exchange rates, aiming to profit from fluctuations in those rates. The Forex market, being the largest and most liquid market in the world, operates round-the-clock five days a week. Within Forex trading, currencies are traded in pairs, and the value of each currency pair changes due to various economic and geopolitical factors. Traders engage in Forex to profit from these currency fluctuations and take advantage of both rising and falling markets. An important aspect of Forex trading is the ability to use leverage, which allows traders to magnify their returns. However, it also introduces greater risk, which requires careful strategy and management.

Market Structure and Trading Hours

Binary options have set expiration times, ranging from as short as 60 seconds to several months, creating a definite timeframe for the outcome. This predefined duration adds a layer of structure to binary options trading, as traders must initiate and conclude their trades within the time constraints. The market for binary options spans multiple asset classes, but it is primarily offered over-the-counter by brokers. This means the trades are conducted directly between parties without the involvement of a traditional exchange. As a result, the role and quality of the broker can significantly influence the trading experience, making it essential for traders to select reliable platforms.

Forex trading is conducted on a decentralized global market. Unlike binary options, Forex does not have a central exchange. Instead, it functions through a network of banks, financial institutions, brokers, and individual traders spread worldwide. The market is open 24 hours a day, divided into major trading sessions to accommodate traders worldwide. These sessions include the Tokyo, London, and New York sessions, each responsible for significant market movements influenced by localized economic data and events. Understanding the timing of these sessions is crucial for effective Forex trading, as liquidity and volatility levels vary throughout the day.

Risk and Reward Mechanism

In binary options, the potential profit and loss are specified upfront, which can simplify the decision-making process. This transparency in risk management is one of the main attractions of binary options, allowing traders to know exactly what they stand to gain or lose from the outset of their trade. However, this also limits the potential gains and losses to the predefined amounts. The fixed-risk nature can thus be appealing to those who prefer a clear understanding of possible outcomes and wish to avoid the complexities of market fluctuations.

Forex trading, while offering the potential for greater profits, also entails the possibility of substantial losses. The dynamic nature of leverage in Forex allows traders to control larger positions than their initial investment would permit, significantly increasing both the potential reward and risk. Leverage is a double-edged sword; while it can magnify profits, it can equally magnify losses, requiring traders to employ effective risk management strategies, such as setting stop-loss and take-profit levels. Therefore, Forex trading demands a higher degree of market knowledge, skill, and diligence to manage the inherent risks involved successfully.

Regulatory Environment

Regulation in binary options has been a topic of concern due to its susceptibility to fraud and scams. The less regulated nature of binary options markets has historically made them a target for fraudulent operations, with some brokers manipulating data or refusing to pay out legitimate profits. Consequently, many countries have implemented stringent regulations or outright bans to protect investors, emphasizing the need for traders to ensure they are using regulated brokers.

Forex trading is generally more standardized and regulated. Reputable Forex brokers are usually licensed and comply with regulations that vary by country. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC), oversee the activities of Forex brokers to maintain market integrity and protect traders. Engaging with well-regulated brokers can mitigate the risks of fraudulent activities and provide traders with recourse in case of disputes. This regulatory oversight means the Forex market enjoys a higher level of trust and transparency compared to binary options.

Conclusion

In summary, choosing between binary options and Forex trading depends largely on one’s investment goals, risk tolerance, and trading style. Binary options offer a more straightforward, fixed-risk alternative, attractive for traders looking for clear and defined outcomes within a specific timeframe. However, potential returns are limited by the capped payout structure. Forex trading, in contrast, provides the opportunity for higher returns, driven by market volatility and leverage, but carries correspondingly higher risks and complexity. Educating oneself about these financial instruments and their associated risks is crucial before engaging in either market. Regardless of the choice, successful trading in both domains demands a disciplined approach, comprehensive analysis, and effective risk management strategies. By understanding these critical distinctions, traders can make informed decisions aligned with their financial objectives and risk tolerance.

This article was last updated on: March 10, 2025